The US Debt Ceiling: Implications of Failing to Raise It

Looming Risk of Default and Global Financial Crisis

The US debt ceiling is a critical component of America's fiscal system, and the world's largest economy is on the verge of running out of money. However, a political stalemate between Republicans and Democrats has created a deepening impasse over whether to raise or suspend the debt ceiling. This article explores the consequences of not raising the debt ceiling and the potential risks it poses to the American and global economies.

Understanding the US Debt Ceiling

Since 1917, the US has had a law that sets a statutory limit on the total amount of debt the government can accumulate. Unlike fiscal rules in the UK, the debt ceiling is externally determined and treated separately from decisions on government spending and taxation. Congress passes spending bills that increase the debt level, but the debt ceiling is only raised when it is about to be breached. Currently, the debt ceiling stands at a staggering $31.4 trillion.

Video: US debt crisis: First-ever US debt default on cards? | World DNA

The Political Stalemate and Failure to Raise the Debt Ceiling

The debt ceiling can be raised through a vote in the House of Representatives, which currently has a Republican majority. In the current administration, where the ruling party lacks a majority in the House, reaching an agreement is uncertain. Republicans are leveraging the deadline to pressure President Joe Biden into agreeing to spending cuts. Although the House approved a bill to raise the debt limit, it is not expected to pass through the Democrat-majority Senate. This political stalemate leaves the American economy in a state of uncertainty and potential turmoil.

Video: What is the US debt ceiling & what happens if it isn’t raised? | WION Originals

Consequences of Not Raising the Debt Ceiling

If an agreement cannot be reached quickly, the US government may face a severe cash shortage by June 1. Treasury Secretary Janet Yellen has warned that the administration will not have enough cash to meet its debt obligations. When the government runs out of money, it can only rely on tax revenue to cover its costs, leading to a failure in meeting public spending obligations and servicing existing debt. The non-repayment of Treasury bonds due in June could trigger a financial crisis with far-reaching implications.

Global Impact of a US Government Default

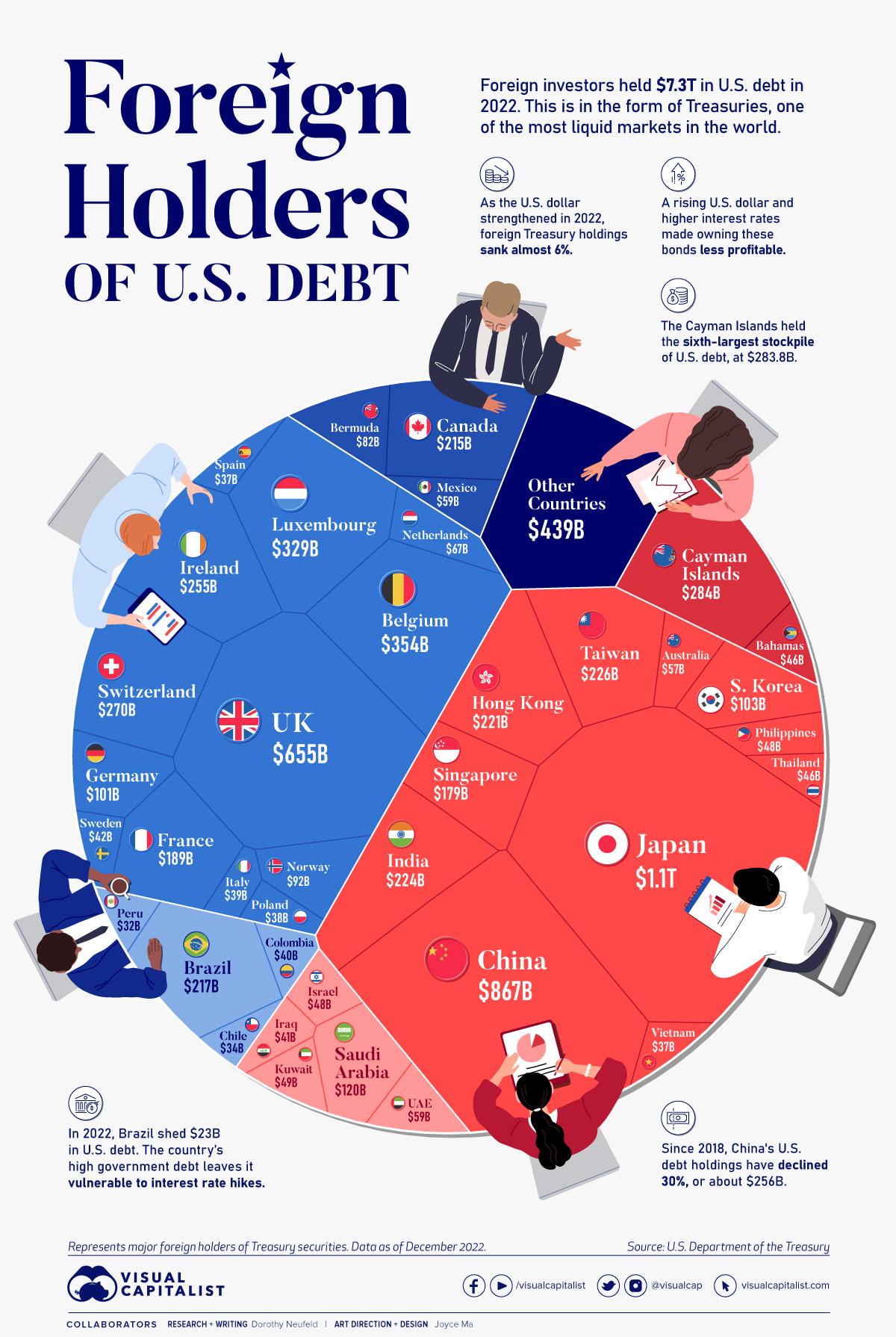

A US government default would have profound global repercussions. US government debt is considered the safest asset in the financial system, and many financial assets derive their value from it. If the US defaults, borrowing costs would rise in America, causing a ripple effect of increased borrowing costs worldwide. Suddenly, every safe asset would appear less secure, leading to significant dislocation in global financial markets. The Organisation for Economic Cooperation and Development (OECD) has warned that a failure to reach an agreement would result in severe macroeconomic consequences, given the current scale of the Federal budget deficit.

Man-Made Problem and Unique Risks

Unlike defaults in countries like Argentina, a default resulting from the debt ceiling is a man-made problem rather than an economic necessity. Although America can afford to pay its debts, it becomes legally bound by the debt ceiling. This artificial risk of default creates uncertainty and complicates the situation. The US has faced similar deadlines in the past, but this time, the stakes are higher. With federal debt at 98% of American GDP and higher interest rates, the government faces significantly higher debt servicing costs, making the situation more precarious.

The Deadline and Urgency to Resolve the Crisis

The deadline to resolve the debt ceiling crisis is imminent. Initially estimated to run out of cash before early June, Treasury Secretary Yellen has now warned that the actual date could be as soon as June 1, with only days or weeks of buffer remaining. President Biden had to cut short his trip to Asia due to the urgency of the situation. The lack of a conclusion during talks between Biden and House Speaker McCarthy adds to the pressing nature of the crisis.

In conclusion

Failure to raise the US debt ceiling poses substantial risks to the American and global economies. The potential for a default and its ripple effects on borrowing costs and financial markets creates an urgent need for resolution. The artificial nature of this problem adds to the complexity and uncertainty surrounding the situation.

Source: The telegraph

- Political Leaders

- Art & Crafts

- Dance & Music

- Sanatan Dharma

- Education & Training

- Food & Drinks

- Gaming

- Health & Fitness

- Home & Gardening

- Literature & Culture

- Love

- Medicine & Ayurveda

- Motors & Vehicles

- Movies & Cinema

- Parenting

- Politics

- Science & Technology

- Shopping

- Social Media

- Spirituality

- Sports

- War & History

- Yoga & Meditation

- Travel & Tourism

- Natural Disaster

- Business & Startups

- DIY & Home Decor

- Finance

- Personal

- News

- Pet Lovers

- Wild Life & Nature

- Podcast & Audio Books

- Poetry

- Law & Order

- Moral Stories

- Jokes & Humour

- Other